The Key Patterns in Dual-Use Technology — Academy Investor Network

- Richard Tippitt, Geoffrey Yang, Ryan Chen, and Ashley Sogge

- Aug 31, 2021

- 12 min read

Updated: Dec 6, 2021

Academy Investor Network conducted a study on dual-use technology companies that have successfully raised over $5M of investor funding. By analyzing 500 dual-use companies, the study reveals patterns amongst these dual-use technology companies that may inform the reader of what to look for in the future.

Introduction

In recent years, countries openly competitive to the United States have invested government money into commercial innovation with the dual-goal of i) advancing their economies and ii) enabling a military/security advantage. This approach enabled these nations to challenge the technological supremacy of the United States, creating both economic and security implications. The U.S. Government realized this and versus taking a top-down/government-led approach, the U.S. Government is working hand-in-hand with the private sector to provide non-dilutive funding to companies based on their ability to raise funding from private investors. As a counter to rising state-directed innovation by foreign adversaries, the government can make many “small bets” on emerging technologies with potential government applications while also ensuring these companies have commercial viability -- the definition of dual-use.

The primary vehicles used by the government to insert capital into startups are the Small Business Innovation Research (SBIR) and Small Business Technology Transfer (STTR) programs. These programs, funded by federal agencies such as the Department of Defense, Department of Health and Human Services, Department of Energy, the National Science Foundation, and NASA, provide non-dilutive funding to small businesses for research and development. Over the past decade, the U.S. increased mandatory SBIR and STTR spending to a minimum expenditure of 3.2% and 0.45% from federal agencies’ budgets with greater than $100M and $1B in R&D funding, respectively, on promising dual-use technology. If one solely considers the number of early-stage companies an entity invests in, the U.S. Government has no rival. For example, the SBIR program inserted money into 7,000+ companies in 2020, whereas there were only 3,400+ companies that received institutional VC funding in 2020.

In contrast to economic and military competitors, like the Chinese Communist Party’s (CCP) military-civil fusion efforts, the U.S. leverages its free-market economy to accelerate commercial technology adoption across all agencies instead of forcing the development of military-specific uses. To maintain its position as the world’s leading economy and have no peer competitors to national security, the U.S. must support unique, government-applicable technology while allowing free-market economics to determine the success and failure of commercial endeavors.

Since the SBIR program was reauthorized in 2000, it has awarded more than $48B -- $3.9B in 2020 alone. This makes the program one of the largest infusions of capital into early-stage (pre-seed to Series A type companies) globally. Beyond the SBIR program, Congress has reiterated its commitment to a “whole of government” approach to improve research and development through recent bills. The bipartisan and Senate-passed United States Innovation and Competition Act (USICA) includes tens of billions of dedicated funding for science and technology research across all sectors. In addition, both the smaller and larger infrastructure bills under consideration include billions more. These recent efforts from the Executive and Legislative branches reaffirm the importance of investing in technology to maintain U.S. economic and security superiority. The ability of the United States to harness its free-market technological prowess is critical, not only as a counter to adversarial states but also as a boon to future innovations that may not have a ready commercial market.

Key Findings

California excels at producing viable dual-use technology companies

An incredible 217 out of 500 dual-use startups in our study claim California as home, dwarfing all other states. Even considered separately, Northern and Southern California fall 1st (182) and 3rd (35) amongst other states, respectively. Despite the reported divide between Silicon Valley and the DoD/government, our research suggests the Bay Area supplies a healthy number of companies focused on dual-use technologies.

But, California is not the only overperforming locale

Austin, TX receives less than 3% of venture capital overall but represents more than 12% of dual-use technologies in this study. A large number of active duty and veteran residents, a growing startup culture, recent efforts by the local government to capture federal initiatives, and DoD innovation hubs such as AFWERX and Army Futures Command headquarters all serve as contributing factors to the outsized number of dual-use companies headquartered in the Austin metropolitan area.

Compared to overall GDP with other states, Virginia and Massachusetts have an outsized number of dual-use companies. Despite having a relatively low federal government or military presence, Massachusetts has the second-highest number of dual-use startups, behind only California. Virginia is fourth overall, likely due to its proximity to Washington DC and significant government presence across the state.

In-Q-Tel is highly effective at funding successful dual-use technology startups

In-Q-Tel is represented by twenty-four investments in our study. While twenty-four may not seem high considering the overall number of companies in this study, In-Q-Tel has only made 167 total investments since its founding in 1999. Conversely, the investment fund most represented in our database, New Enterprise Associates, has invested in thirty companies despite having made over 2000 investments during the period of this study. Thus, In-Q-Tel’s success rate backing companies and technologies of interest to the government is extraordinarily high.

Cybersecurity, following recent federal trends, leads all other sectors

Cybersecurity has more than double the number of dual-use companies than the next sub-industry in this study. Cybersecurity support functions such as analytics, AI/ML, identity management, and data management represent four of the following six subcategories. Previous investments in cybersecurity are proving beneficial, and the latest push to improve cybersecurity will only increase this gap.

Founders’ demographics do not match commercial statistics

Across all categories, minorities or underrepresented groups represent a higher percentage of founders in our study compared to the national average. In addition, each category is higher as well as the aggregate. For instance, Latino and Black founders make up 1% of all startups in the United States, whereas these two groups each have a 2% share in the dual-use market. The percentages remain unacceptably low, but the data suggests the dual-use ecosystem is performing better than the overall early-stage investment ecosystem.

Most founders do not have military and/or government experience

Surprisingly, only seventy-five, or 15%, of founders have government experience to include large prime contractors. Thus, there is no direct link to government experience and building a successful dual-use technology. It seems that efforts to include non-traditional vendors (and personnel) helped to flip the paradigm for newer federal vendors.

Methodology

To generate our database, we utilized Pitchbook, Capital IQ, and Crunchbase to screen for companies that fit the following criteria:

Dual-use technology: both commercial and government (not necessarily military) applications

Raised at least USD $5M in investment funds

Underwent a Series A or later VC round

Founded after the year 2000

Still operational or acquired

Headquartered in the United States or Western Europe

Applying these criteria, we generated an initial list of 729 companies. We then examined each of the companies in the initial list, filtering out those that did not meet our standard for dual-use until we were left with 500 in our final sample. Finally, from the shortened list of company names, we created our database by pulling data on these select companies from a single source (Crunchbase) and verifying information when possible from Pitchbook. In addition, we filled in missing information, such as founder demographics and accelerator history, through LinkedIn and manual searches.

It is essential to acknowledge that in our initial data collection, we concentrated our efforts on companies that explicitly market themselves as dual-use technologies or have technologies that have clear use cases applicable to both commercial and government markets. As a result, it is possible our database does not adequately capture companies with technologies that the government could potentially use, but for which the government is not their primary focus (e.g., health tech). Furthermore, despite recent trends in the aerospace market towards commercialization, several aerospace companies that perhaps could have been included in our analysis were excluded because there is not yet a strong enough commercial market for those technologies. Nevertheless, our sample is representative enough to offer valuable insights and serve as a base for further research.

Headquarters Locations

HQ regions: California leads the way

We begin with headquarters locations. Unsurprisingly, California is a leader in dual-use technology startups, with 43% of our sample set being based in the state. Also noteworthy is the “Acela Corridor,” consisting of the DMV, NY, and Massachusetts areas.

HQ cities: Austin punches above its weight

The Bay Area region leads the way with six-member cities in the top ten HQ cities. New York and Austin also have a notable presence. Austin received just 3% of American VC investment but is home to 12% of the sample companies.

Key Industries

Broad industries: Agencies require back-office assistance

In our analysis, we classified dual-use technology companies into eight major categories. This chart illustrates the dominance of AdminTech, i.e., IT and other back-office services that improve the government's internal operations. We surmise there are so many government agencies that need administrative help, the market is large enough to support many companies. Note the small presence of SpaceTech and HealthTech companies. This discrepancy may be due to the high barrier of entry that those markets have historically posed. Despite efforts over the past few years to incorporate non-traditionals into the space ecosystem (especially with the creation of Space Force in 2019), the space startup ecosystem is still in its infancy, with large primes continuing to dominate the majority of the market.

Specific industries: The growing importance of data

In our analysis, each company was further assigned a specific industry classification. Following recent VC trends and national exposure, cybersecurity leads all other industries: the seventy cybersecurity companies are double the next largest category. In addition, industries such as analytics, geospatial, and artificial intelligence demonstrate the growing importance of data and data science to government function at all levels.

Other Company Details

Founding dates: Growth in dual-use over time

Dual-use tech companies appear to follow the same development trajectory as other startups. After the dot-com crash, we see a gradual increase in the number of dual-use companies founded. However, the numbers taper off as we approach the present day because most companies take 3-4 years to raise the $5M required to meet our analysis threshold.

Technology type: Software leads

Less than a third of the companies in the sample are hardware companies. It appears that major prime contractors continue to dominate the sale of hardware platforms to the government, while venture-backed startups struggle to break into dual-use hardware. In contrast, the large presence of software companies is likely due to recent improvements to software acquisition methods and the commercial market focus on software solutions.

Founder Demographics

Founding team size: Small teams

56% of companies in the sample have two to three-person founding teams, while just 11% have more than three founders. This finding aligns with conventional business wisdom that says multiple founders give the startup increased legitimacy, but having too many founders can lead to internal issues.

Startup experience: Prior startup experience is not essential

The majority of founders in our sample do not have previous startup experience. This does not necessarily indicate that prior startup experience is not useful in the dual-use market. It seems this market does not devalue those with novel approaches and little experience, which we believe is a good thing to have a robust innovation ecosystem.

Government experience: Not so important

The overwhelming majority of founders did not have any previous military or government agency experience before founding their company. This suggests that “insider knowledge” is not required to build a product that solves government pains or to navigate selling to the government. Furthermore, this could be an indicator that the government is doing a better job attracting companies with employees who have no previous history of working with the government.

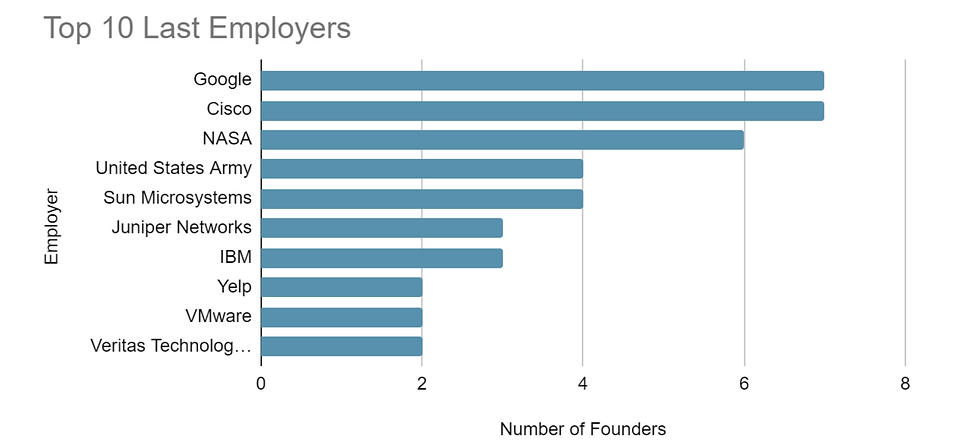

Past employment: No clear pattern

The last employment of these founders is diverse (433 unique employers for 500 founders), with no clear patterns. Despite billing themselves as hubs for innovation and creativity, large tech companies like Google and Cisco hold little sway. The 21 founders with no previous work experience are more prevalent than any unique past employer in our sample.

Age of founders: Consistent with other studies

The majority of dual-use tech entrepreneurs are 30 years or older at the time of founding. The average age is 37.4, which is close to but slightly lower than the average age of 41.9 for all venture-backed startups cited by a 2019 Wharton study. The lower average age in our sample may be due to the prevalence of first-time founders.

Diversity: Better than other industries, but work remains to be done

11% of companies in our sample had a woman on their founding team, and 38% of teams had some measure of diversity. These numbers are low but better than industry averages. In a sample of 4,500 startups from the top VC firms in America, a 2019 RateMyInvestor/DiversityVC study notes only 9.2% of founders were female.

Our sample contains 2% Black founders versus 1% in the study above; 1.8% versus 1% Hispanic founders; 22% versus 18% Asian founders; and 6.6% versus 2.4% Middle Eastern founders. Across the board, minority founders are better represented in dual-use technology than in VC-backed companies as a whole. One potential reason for the higher percentage of Middle Eastern founders is that Israeli founders were considered a part of that group, Israel having a long history of innovation in DefenseTech.

Degree types: Technical backgrounds

94% of founders have an undergraduate degree, with the majority having a technical background (science and engineering degrees in that category). Although the notion of the college-dropout-genius founder looms large in the public imagination, for dual-use tech, it appears that having a thorough technical grounding is critical for startup success.

It may be surprising that 42% of dual-use founders do not have a graduate degree, and only 11% of founders have a Ph.D. However, in a 2009 study by The Kauffman Foundation on 549 startups in all industries, 48% of founders had only a bachelor's degree. Thus, we can infer that dual-use still places a higher value on advanced technical education than the average. To further reinforce this point, dozens of MBA holders in the sample obtained an MSc beforehand, but this is not reflected in the chart. In our research, only the most recent graduate degree earned was recorded.

Schools: “Top” institutions dominate

There are no real surprises for undergraduate schools - founders mostly come from the Ivy League, plus Stanford, MIT, and the most selective public universities in the country. Our top 10 list is almost identical to the top 10 institutions ranked by Crunchbase News in 2020 based on the number of alumni that have founded startups across all industries. University of Illinois Urbana Champaign’s position at #5 may be unexpected, but it can be explained by its well-known engineering program and its 34,000-strong undergraduate enrollment. The relatively low representation of the service academies is noted: the U.S. Naval Academy boasts four founders, while the U.S. Military Academy at West Point and the U.S. Air Force Academy have one each.

The graduate schools most represented are in line with where startup founders come from in other industries. It must be noted that those schools that have a strong engineering program are well represented.

The majority of PhDs in our sample were in computer science, which helps explain why MIT and Stanford dominate the list.

Investors and Accelerators

Government grants: Growing in importance over time

Just over a third of companies in the sample received funding under SBIR/STTR. Our findings show government grants are growing in importance as a source of funding over time: for the 306 companies founded in 2010 or later, 48% received SBIR/STTR, versus just 15% for companies founded before 2010. We see this fact growing over time as more government funding into R&D increases. The SBIR program has three phases. SBIR phase I enables a company to win a $50K non-dilutive grant, and a phase II allows a company to win a $750K non-dilutive grant. To secure a phase III grant, the startup must find a “sponsor” within the government, and they must simultaneously raise funding from a third party (private investor). The government entity sponsoring the company will match dollar-for-dollar up to a certain dollar amount.

Most common investors: In-Q-Tel fulfilling its mission

Turning to investors, New Enterprise Associates leads the way, appearing in the top five of the cap table for thirty companies on our list. Most notable, however, is In-Q-Tel. Despite being the only government-backed investor in the top twenty, it still ranks second on the list. Furthermore, In-Q-Tel has only made 167 investments since its founding in 1999 compared to almost 2000 by NEA, 399 by Alumni Ventures Group, and 564 by Andreesen Horowitz. With such a high hit rate in dual-use tech, we can conclude In-Q-Tel has succeeded in investing in viable companies developing relevant technologies in support of its mission statement to support US intelligence. Finally, it is notable that although Techstars and Y Combinator are equally popular as accelerators (see next section), Techstars maintains a larger proportion of dual-use companies in its portfolio.

Accelerators: No real surprises

Plug and Play, Techstars, and Y Combinator top the list when it comes to accelerator programs. The top 10 accelerators from our sample are more or less the most respected accelerators in American venture capital.

Operational status: Mostly private companies

The overwhelming majority of companies in our sample are still private. However, it appears improvements in acquisitions pathways mean companies no longer have to be huge public corporations to sell to the government.

In terms of acquirers, there is no clear trend. A few legacy technology companies have acquired multiple dual-use startups on our list, but the vast majority of acquirers only make a single appearance. One hundred thirty-seven companies have been acquired compared to just 33 that have gone public, meaning an acquisition is four times more probable exit strategy than an IPO for dual-use tech companies.

Next Steps for Continued Research

At Academy Investor Network, we will continue to track this project over time and build upon it with further research initiatives, consistent with our position as thought leaders in the dual-use technology space. If you are a founder of a dual-use technology company or would like to collaborate with us on further research, please reach out to us at richard@academyinvestor.com.

AIN Ventures is an early-stage investment fund that invests in dual-use technology startups and veteran-led startups (industry agnostic). For more information, please visit our website at www.academyinvestor.com.

Works Consulted

Azoulay, P., Jones, B. F., Kim, J. D., & Miranda, J. (2020). Age and High-Growth Entrepreneurship. American Economic Review: Insights, 2(1), 65–82. https://doi.org/10.1257/aeri.20180582

Florida, R. (2018, March 27). The Extreme Geographic Inequality of High-Tech Venture Capital. Bloomberg.Com. https://www.bloomberg.com/news/articles/2018-03-27/the-extreme-geographic-inequality-of-high-tech-venture-capital

Glasner, J. (2021, March 19). Here’s Where Funded Founders Went To School. Crunchbase News. https://news.crunchbase.com/news/heres-where-funded-founders-went-to-school/

RateMyInvestor & DiversityVC. (2019). Diversity in U.S. Startups. https://ratemyinvestor.com/DiversityVCReport_Final.pdf

Siebeneck, T., & Wang, C. (2021). Gross Domestic Product by State, 1st Quarter 2021 (p. 8). U.S. Bureau of Economic Analysis. https://www.bea.gov/sites/default/files/2021-06/qgdpstate0621.pdf

Wadhwa, V., Holly, K., Aggarwal, R., & Salkever, A. (2009). Anatomy of an Entrepreneur: Family Background and Motivation. SSRN Electronic Journal. https://doi.org/10.2139/ssrn.1431263

Comments